Employers, What Should Your COLA be in 2023?

With a challenging labour market, rising costs and little certainty about the economy’s direction, Canadian employers may be more uncertain about correctly calculating their cost of living adjustment should be for 2023.

Employers, especially small to mid-size organizations that don’t have a squad of economists to ask wage-related questions, can often find guidance in what the Canadian pension funds are recommending.

In our province, the Alberta Teachers Retirement Fund uses the difference in year-over-year prices for the Alberta Consumer Price Index (ACPI). The ACPI, which is specific to Alberta, tracks the price changes on a fixed basket of goods, which includes:

- Shelter

- Transportation

- Food

- Recreation, Education & Reading

- Household Operations, Furnishings & Equipment

- Clothing & Footwear

- Health & Personal Care

- Alcoholic Beverages & Tobacco

The ACPI index has risen 6.20% in the 12 months ending October 2022 compared to the previous term.

For comparison, here are some recent yearly ACPI differences:

Source: ATRF

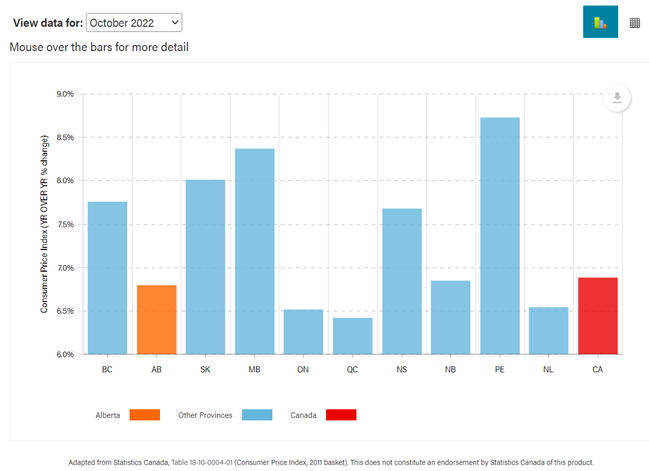

By comparison, several large pension funds use the Canadian Consumer Price Index, which tracks the broader Canadian market. The CPI rose in Canada by 6.8%, as it did in Alberta, during the same 12-month period.

Here is how Alberta stacks up against the rest of the country using CPI:

For our American friends, in October, the Social Security Administration announced that retirees under their plan would receive an 8.7% COLA in 2023. This is the single largest increase in adjustments in 40 years.

Pension funds are tasked with safeguarding and protecting their plan holders’ investment and can be usually counted on to take a conservative approach to this task. When considering their COLA for 2023, Employers can use the above information as one of the reference benchmarks in their calculation.

Sara Tharakan is a Chartered Professional in Human Resources (CPHR), speaker, executive coach, and certified master trainer. She pulls from over 25+ years of experience in both the public and private sector and excels at helping organizations achieve results by getting the most out of their human capital. Her company, Strategic HR Services offers project-based engagements to fill specific HR gaps in your organization, HR Management & Advisory services to act as your HR team to develop and implement your HR program, and ongoing Mentoring to guide your in-house staff in implementing your HR program.

Sara is certified in:

– Psychological First Aid, The Johns Hopkins University

– TypeCoach, TypeCoach LLC

– Dare to Lead, Brene Brown

– ADKAR Change Management program, Prosci Canada

– Myers Briggs Type Indicator (MBTI) Step I and II, Psychometrics Canada

-Group (GSI), Life (LSI) and Culture Inventory (OCI), Human Synergistics Canada

– Operations Leadership, Queens University

– Executive Project Leadership, University of Alberta

– Customer Service and Leadership, Disney Institute

– Brain-Based Coaching, Results Coaching Systems

– Lominger Competency Model, Lominger International

– Halogen Performance Management, Halogen Performance Management

– Hay Compensation, HAY Group

– Adult Trainer ~ Master Trainer Level, Langevin Learning Services

– Return on Investment, ROI Institute